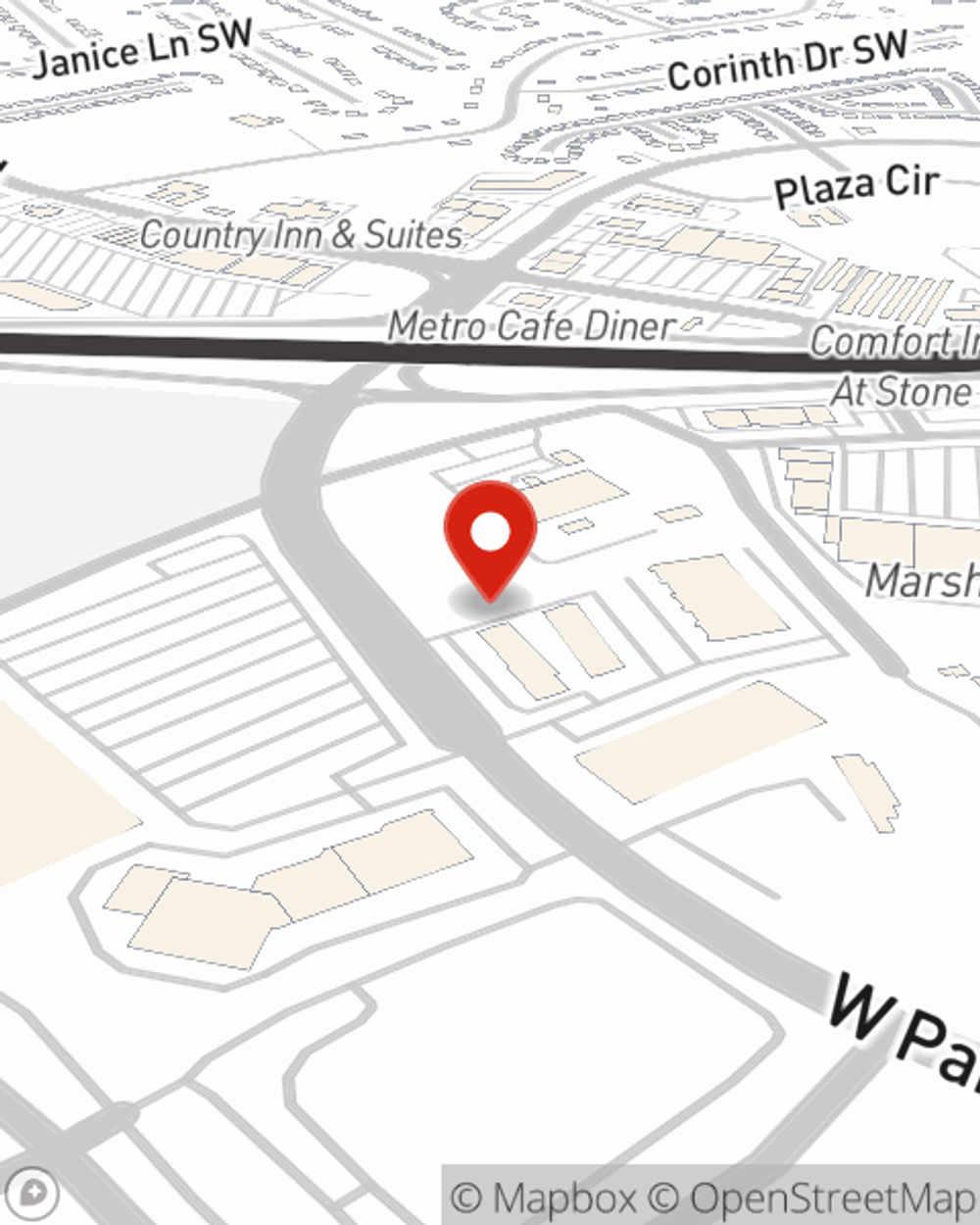

Business Insurance in and around Stone Mountain

One of the top small business insurance companies in Stone Mountain, and beyond.

Insure your business, intentionally

- Stone Mountain

- Decatur

- tucker

- lithonia

- Stone Crest

- Lilburn

- Snellville

- Lawrenceville

- Duluth

- Chamblee

- Buckhead

- Lithia Springs

- Roswell

- McDonough

- Stockbridge

- Fort Valley

- Warner Robins

- Centerville

- Bonaire

- Atlanta

- Douglasville

- Perry

- Byron

Your Search For Reliable Small Business Insurance Ends Now.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, errors and omissions liability and extra liability coverage, you can feel comfortable that your small business is properly protected.

One of the top small business insurance companies in Stone Mountain, and beyond.

Insure your business, intentionally

Small Business Insurance You Can Count On

Whether you own a pizza parlor, a HVAC company or a drug store, State Farm is here to help. Aside from excellent service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by reaching out to agent O Smith's team to talk through your options.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

O Smith

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.